by Reed Hartman

11/11/2024

Ecommerce fraud has become a pervasive issue in today's digital marketplace. With global ecommerce sales projected to reach $6.3 trillion by 2024, the risks associated with online fraud are growing in parallel.

In fact, recent studies show that ecommerce businesses worldwide lose billions of dollars each year to various types of fraud, from identity theft to payment fraud and other scams. As the ecommerce landscape continues to expand, so too does the complexity and frequency of fraudulent activities.

For businesses, protecting both their customers and their own assets has never been more critical. A secure shopping environment not only helps foster trust but also shields the business from financial losses and reputational damage.

Implementing robust fraud prevention strategies is essential, as it enables ecommerce companies to mitigate risks while ensuring a seamless and safe shopping experience for customers. In this rapidly evolving industry, staying ahead of potential threats is key to sustaining growth and long-term success.

What is ecommerce fraud?

Ecommerce fraud refers to any illegal or deceptive activity carried out during online transactions with the intent to steal money, personal information, or goods. It typically involves exploiting vulnerabilities in an ecommerce platform’s systems or manipulating user behaviours to gain unauthorised access to sensitive data or financial resources.

Given the reliance on digital payment systems, ecommerce fraud often targets credit card transactions, digital wallets, or account logins. The anonymity of the internet further emboldens fraudsters, making it easier for them to operate without the fear of immediate consequences.

There are several types of ecommerce fraud, including identity theft, phishing, friendly fraud (also known as chargeback fraud), and account takeover. These tactics can result in significant financial loss for both the customer and the business.

Moreover, ecommerce fraud can cause long-term damage to a company's reputation, eroding customer trust and impacting future revenue. As more consumers turn to online shopping, fraudsters are also evolving their methods, continuously developing new techniques to bypass security measures.

Types of ecommerce fraud

Ecommerce fraud takes many forms, each designed to exploit vulnerabilities in online transactions or the digital presence of businesses. As ecommerce continues to grow, fraudsters are becoming more sophisticated, employing diverse tactics to steal goods, money, or sensitive data during or after the checkout process. The following are some of the most common types of ecommerce fraud, each presenting unique challenges for businesses striving to protect their customers and maintain trust.

Credit card fraud

Credit card fraud encompasses any unauthorised purchases made with a credit or debit card to make purchases or withdraw funds. This broad category includes methods such as card-not-present (CNP) fraud, where stolen card details are used for online transactions, and card testing, where cybercriminals test the validity of card numbers by making small purchases before using them for larger, fraudulent transactions.

These types of fraud are especially challenging for online merchants, as they cannot physically verify a customer’s identity or the legitimacy of the card being used through an issuer using tools like card verification value or CVV codes.

Triangulation fraud

Triangulation fraud is a more sophisticated form of ecommerce fraud that involves three key players: the fraudster, the innocent shopper, and the unsuspecting ecommerce merchant.

Here's how it works: a fraudster sets up a fake storefront or sells discounted products on legitimate platforms. When a customer purchases an item, the fraudster uses stolen credit card information to buy the product from a legitimate store, which ships the product to the customer. Meanwhile, the legitimate merchant is left with a fraudulent transaction and the cardholder eventually disputes the charge.

This type of fraud is particularly damaging because it affects multiple parties — the merchant loses the product, the customer unwittingly receives stolen goods, and the cardholder is left with fraudulent charges. According to research by the Federal Trade Commission, ecommerce fraud losses in 2022 were estimated at $8.8 billion, with triangulation fraud playing a significant role in those figures.

Friendly fraud

Friendly fraud, also known as first-party fraud, occurs when a legitimate customer makes a purchase but later disputes the charge with their credit card company, claiming they never received the product or that the transaction was unauthorised. This type of fraud is often categorised into three types:

Innocent or accidental request: This occurs when a customer genuinely does not recognise the charge or forgets about a purchase, leading to a chargeback.

Opportunistic friendly fraud: Here, the customer may have received the product but claims they did not, hoping to get a refund or keep the product for free.

Malicious friendly fraud or chargeback fraud: In these cases, customers knowingly make a false claim in order to receive a refund for a legitimate purchase, a tactic used to exploit businesses.

Refund abuse

Refund abuse, sometimes called return fraud, occurs when customers take advantage of a retailer’s return policy. This type of fraud can include tactics like returning used or worn items as new, or falsely claiming they did not receive an order to get a refund. As more online stores offer generous return policies to attract customers, fraudsters exploit these policies, leading to significant financial losses.

Refund abuse is on the rise, with retailers expected to lose over $101 billion annually due to fraudulent returns, according to the National Retail Federation (NRF). For instance, online retailers selling clothing are particularly vulnerable, as fraudsters frequently buy, wear, and return outfits under the guise of a legitimate return.

Account takeover fraud

Account takeover fraud occurs when fraudsters gain unauthorised access to a customer’s online account, typically through phishing attacks, data breaches, or the use of stolen credentials from the dark web. Once inside the account, the fraudster can change passwords, make purchases, or even use saved payment information to commit further fraud.

Affiliate fraud

Affiliate fraud occurs when individuals or companies attempt to manipulate an affiliate marketing programme for personal gain. This type of fraud typically involves generating fake traffic, clicks, or conversions to earn commission from the merchant or affiliate network. Fraudsters use bots, fake accounts, or even incentivised traffic to inflate their numbers, leading to inaccurate payouts for genuine sales or leads.

Each of these types of ecommerce fraud presents unique challenges for businesses, but by understanding their nuances and implementing robust security measures, ecommerce companies can significantly reduce their risk of falling victim to fraud.

How to identify and mitigate risks with ecommerce fraud detection

Detecting and responding to ecommerce fraud requires constant vigilance and a multi-layered approach to security. Fraudsters often use sophisticated techniques, so businesses need to implement proactive monitoring and response strategies to mitigate risks.

Leveraging tools like real-time fraud detection, chargeback management, and data-driven insights, ecommerce businesses can stay one step ahead of fraudsters while minimising financial losses and protecting their customers. Here's how businesses can identify various types of fraudulent activity and respond effectively.

Regular fraud monitoring

Real-time fraud detection is essential for any ecommerce business looking to minimise the impact of fraudulent transactions. Monitoring transactions as they occur enables businesses to flag suspicious behaviour instantly, allowing for quick responses before fraudulent orders are processed. Tools that provide continuous surveillance of orders and customer activity can catch fraud patterns, such as repeated purchase attempts with declined cards, preventing losses before they happen.

Chargeback management

Chargebacks are one of the most common types of fraud that ecommerce businesses face, but managing them effectively is key to minimising their impact. Platforms like BigCommerce offer tools to streamline chargeback management, helping businesses identify fraud triggers, reduce chargeback occurrences, and respond efficiently to disputes. By analysing chargeback data, businesses can build defence strategies against both friendly fraud and criminal fraud, ensuring quicker resolutions and lower chargeback rates.

Data-driven security decisions

The ability to leverage data insights is crucial in staying ahead of potential fraud threats. BigCommerce provides advanced analytics that help businesses spot patterns and anomalies in customer behaviour.

By analysing data on customer orders, locations, payment methods, and other transaction details, businesses can make more informed security decisions. This allows them to detect early signs of fraud, like inconsistent order data or spikes in activity from a particular region, and take action to prevent it from escalating.

Identifying Fraudulent Activities

Inconsistent order data: If the billing address, shipping address, or contact information doesn’t align with typical customer behaviour, it could be an indicator of fraudulent intent, especially if the same person is making multiple orders with differing details.

Larger than average order: Fraudsters often attempt to place abnormally large orders, hoping to maximise their gain before the fraud is detected. Orders that far exceed your average order value should trigger further investigation.

Unusual location: If an order originates from a high-risk location or an unfamiliar country, particularly one you don’t frequently ship to, it may be a red flag. Fraudsters often use international locations to obscure their tracks.

Multiple shipping addresses: A customer placing several orders and shipping them to different addresses, especially within a short period, could be trying to hide their activity or distribute fraudulent purchases. An address verification service or AVS can be helpful in these instances.

Many transactions in a short timeframe: A sudden burst of purchases from the same customer or account can indicate card testing or an attempt to make multiple fraudulent transactions before the account is flagged.

Multiple orders from many credit cards: A single customer using several different credit cards for multiple purchases in a short span of time can signal fraud. This is often a sign of stolen card numbers being tested or used in succession.

Multiple declines in a row: Repeated payment failures followed by a successful one may indicate that a fraudster is trying to guess card numbers or test the validity of stolen cards.

Strings of orders from a new country: If you notice a series of new orders from a country you don’t normally receive orders from, it could signal fraud, especially if the order volumes or patterns are unusual.

By recognising these indicators, businesses can intervene before significant damage is done, either by blocking suspicious transactions or further verifying order details to ensure legitimacy.

Ecommerce fraud prevention best practises

In the ever-evolving ecommerce landscape, fraud prevention must be a top priority for businesses looking to protect both their customers and their operations. Fraudsters continuously search for new ways to exploit weaknesses in online platforms, making it essential for ecommerce companies to stay vigilant and adopt best practises to mitigate these risks.

Strong authentication policies

One of the most effective ways to protect customer information is by enforcing strong authentication policies. Requiring customers to create strong, unique passwords for their accounts helps minimise the risk of unauthorised access. Weak passwords are easily exploitable by hackers, especially through brute-force attacks, where automated programs attempt to guess login credentials. Encouraging — or even requiring — customers to use complex passwords, combining letters, numbers, and special characters, strengthens security.

To enhance account protection further, ecommerce businesses should implement two-factor authentication (2FA) or multi-factor authentication (MFA). This additional layer of security ensures that even if a password is compromised, a secondary authentication method like a security code is required to access the account. These measures greatly reduce the chances of fraudulent access to customer accounts, protecting both users and businesses from unauthorised transactions.

Regular software updates

Keeping ecommerce systems up to date is another critical practise for preventing fraud. Criminals are always on the lookout for vulnerabilities in outdated software, including plugins, themes, and backend systems. If businesses fail to install updates in a timely manner, they leave themselves open to potential data breaches or attacks that could compromise customer information.

Shopping cart plugins, website themes, and third-party apps are some of the most commonly targeted components. These systems often contain security patches in updates that protect against newly discovered vulnerabilities. Failing to apply these patches leaves the door open for hackers to exploit known weaknesses, potentially leading to large-scale data breaches or unauthorised access to sensitive data.

Fraud detection filters

Setting up fraud detection filters is another essential practise for ecommerce business owners. These filters allow businesses to automatically flag or block suspicious transactions based on predefined criteria. For example, transactions from high-risk locations, orders that exceed a certain threshold amount, or multiple orders placed in a short time frame can all be red flags for potential fraud.

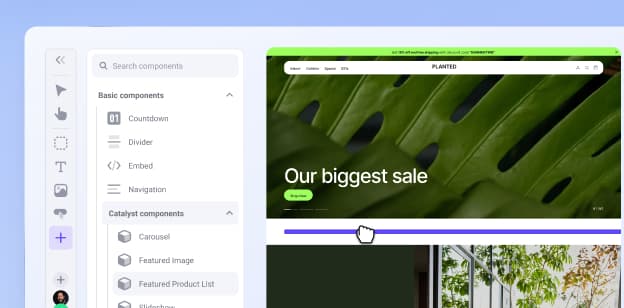

By establishing rules that detect abnormal behaviour, businesses can stop fraudulent transactions before they go through, protecting themselves from chargebacks and financial losses. Many ecommerce platforms, including BigCommerce, offer customisable fraud filters that can be adjusted based on the specific risk factors and patterns a business may face. This proactive approach ensures that suspicious activity is caught early and dealt with effectively.

Secure payment gateways

Choosing a secure payment gateway is fundamental to protecting customers and businesses from fraud. A payment gateway acts as the middleman between the customer and the business, processing transactions securely. However, not all payment gateways offer the same level of protection. Ecommerce businesses should prioritise payment processors that provide robust security features, including encryption and tokenisation.

Encryption ensures that sensitive customer data, such as credit card information, is securely transmitted, preventing unauthorised access during the transaction process. Tokenisation replaces sensitive data with a unique identifier, or token, which cannot be used outside of the specific transaction, adding another layer of protection. Fraud protection tools like these are crucial for preventing data theft during payments.

Get more information on choosing the payment gateway that’s right for your business here.

SSL certificates

An SSL (Secure Sockets Layer) certificate is another must-have security feature for ecommerce businesses. SSL certificates encrypt sensitive information during online transactions. This encryption ensures that any data transmitted between the customer and the business’s server is secure, preventing hackers from intercepting it.

In addition to protecting data, SSL certificates are essential for establishing customer trust and a positive customer experience. When a website has an SSL certificate, the URL begins with "https://" and displays a padlock icon, indicating that the site is secure. This visual reassurance can increase customer confidence, as they know their information is safe. Without an SSL certificate, businesses not only risk data breaches but also lose credibility with their customers.

By implementing these best practises, online businesses can significantly reduce their exposure to fraud while protecting their customers’ sensitive information. Investing in these strategies ensures a more secure shopping experience, building trust and long-term success in the competitive world of ecommerce.

How BigCommerce Helps Protect Businesses with Ecommerce Fraud Prevention Solutions

As ecommerce fraud continues to evolve, businesses need comprehensive and reliable solutions to safeguard their operations and customer data. BigCommerce offers a robust set of fraud prevention and security features designed to protect businesses from the growing threats in the digital marketplace.

With a strong commitment to security certifications, platform integrity, and performance, BigCommerce equips merchants with the tools and resources necessary to minimise fraud risks while maintaining optimal performance.

Security certifications and compliance

Security certifications and compliance are critical for building trust with customers and ensuring that businesses adhere to industry standards designed to protect sensitive information. BigCommerce is PCI DSS 4.1 Level 1 Attestation of Compliance, ISO/IEC 27001:2022, ISO/IEC 27701:2019, ISO 22301:2019, ISO/IEC 27017:2015, ISO/IEC 27018:2019, a global standard that sets out the criteria for an information security management system (ISMS). This certification demonstrates that BigCommerce meets strict requirements for securing customer data, minimising risks, and implementing continuous improvements in security practises.

BigCommerce is also PCI DSS 3.2, Level 1 certified as both a customer and Service Provider. This certification, which is the highest level of compliance within the Payment Card Industry Data Security Standard (PCI DSS), ensures that BigCommerce maintains stringent security protocols for processing, storing, and transmitting credit card information. This means businesses using the platform can trust that their payment processing complies with the highest security standards.

BigCommerce's adherence to CCPA (California Consumer Privacy Act) and GDPR (General Data Protection Regulation) further underscores our commitment to protecting customer data in line with the most comprehensive data privacy laws in the world. By meeting these standards, BigCommerce helps businesses remain compliant across various jurisdictions, safeguarding customer information and reducing the risk of regulatory penalties.

Platform security features

BigCommerce provides extensive platform security features that not only protect businesses but also help reduce total cost of ownership by minimising manual maintenance. One of the key advantages is that BigCommerce performs automatic security and platform updates, reducing the risk of vulnerabilities that fraudsters often exploit.

By keeping the platform up to date, we ensure that businesses are protected against new security threats without requiring them to manually implement updates, freeing up resources and reducing operational costs.

In addition to automatic updates, BigCommerce offers two-factor authentication (2FA) as an added layer of security. This feature helps protect user accounts by requiring a second verification step during login, which significantly reduces the risk of account takeovers, one of the most common types of ecommerce fraud.

BigCommerce is built on the Cloudflare Network, providing enterprise-grade security on a global scale. This infrastructure enhances BigCommerce’s ability to defend against Distributed Denial of Service (DDoS) attacks and other malicious activities, helping ensure the security of ecommerce operations worldwide. Cloudflare also accelerates website performance by optimising content delivery, which is crucial for maintaining a fast and secure shopping experience.

Integration with fraud prevention solutions

BigCommerce integrates seamlessly with leading fraud detection and prevention tools, giving businesses access to advanced security solutions. For example, integrations with services like Signifyd help automate and protect the ecommerce experience by offering real-time fraud management and chargeback management, and help optimise the review process by removing the need for manual review of every single charge.

These tools use artificial intelligence (AI), machine learning, algorithms, and data analysis to detect fraudulent behaviours and automatically block high-risk transactions, reducing the financial impact of chargebacks and fraudulent orders.

Dependable performance

In addition to robust security features, BigCommerce ensures dependable performance, with a 99.98% uptime, including 100% uptime during Cyber 5 (the high-traffic period between Thanksgiving and Cyber Monday) for the past eight years. This reliability ensures that businesses do not experience downtime during critical sales periods, allowing them to capitalise on high-traffic events without fear of technical disruptions or missed opportunities.

Through a combination of security certifications, robust platform features, integrations with fraud prevention tools, and dependable performance, BigCommerce delivers a comprehensive suite of solutions to help businesses mitigate the risks of ecommerce fraud. By adopting these features, businesses can operate confidently, knowing they are protected from threats while maintaining peak performance during even the busiest shopping periods.

The final word

Ecommerce fraud prevention is essential as online threats grow more sophisticated. By implementing strategies like strong authentication, real-time monitoring, and secure payment gateways, businesses can protect both their customers and their bottom line from data breaches and chargebacks.

Choosing a platform like BigCommerce, with built-in security features and fraud prevention tools, is key to minimising risks. Investing in a secure platform helps businesses build trust, reduce financial losses, and ensure long-term success in a competitive marketplace.

—

FAQs about ecommerce fraud prevention

Reed Hartman

Reed Hartman is a Content Marketing Manager at BigCommerce, where he uses his years of research, writing and marketing experience to help inform and educate business owners on all things ecommerce.